The financial sector has evolved a lot in the last few years, if you take a close look at it. Most tasks, for which customers used to visit the physical branches of their desired banks, can now easily be done through the mobile apps of respective financial institutions. Thanks to technologies like AI, ML, Blockchain, and Big Data that are powering these innovations for customers and banks alike.

Are you also looking for a money management solution through which you can generate a massive amount of revenue?

In this article, we will discuss the top 10 fintech app ideas for startups and small & medium businesses that you can implement in 2026 to build an excellent, profit-making digital financial solution. Let’s first give a quick look at:

A Deep Dive into the Fintech App Industry

The fintech app market size was worth USD 371.6 billion in 2024, which is expected to exceed USD 1,026 billion by 2032, growing at a rate of 16.1% between 2026 and 2032.

Not just this, the revenue generation from the fintech market has also increased to a great extent. Take, for instance, the fintech revenue globally was almost $90 billion in 2017.

Fast forward to 2025, the revenue surged by more than 100% and is projected to touch the $201.91 billion mark in 2025. Thus, if you are planning to start your next venture in the fintech industry anytime soon, 2026 is the best year to invest in fintech business ideas.

Additionally, if you need technical assistance to turn your fintech application idea into a real-life solution, InnovationM is your go-to partner for this task.

5 Solid Reasons to Invest in a Fintech App

Putting your money on fintech app ideas 2026 can open up new business opportunities so that you can connect with your target customers and generate abundant revenue. Want to know how? Here are five key drivers of fintech investment:

- Increasing Smartphone Penetration: Extensive adoption of smartphones across the globe is powering the usage of fintech applications. It’s because mobile phones are becoming the main access point for accessing financial services worldwide.

- Growing Digital Payment Adoption: The global shift towards digital payments is augmenting the demand for fintech apps as businesses and customers are distancing themselves from traditional cash transactions.

- Surging Demand for Financial Inclusion: The need to provide banking services to people with no or limited access to bank accounts is encouraging modern fintech app development. Such platforms offer better alternatives to the traditional financial ecosystem.

- Soaring Customer Expectations: Today’s customers are asking for customized financial services that leverage AI, data analytics, and other similar technologies to deliver hyper-personalized recommendations and solutions.

- Expanding Regulatory Support: Government regulations and open banking frameworks are boosting fintech innovations by requiring traditional financial institutions to share consumer data with authorized third-party service providers.

So, the fact of the matter is that if new fintech app ideas are crossing your mind, the present market condition is highly suitable for successfully launching a financial application. In case you need help in building one, InnovationM is the best fintech app development company out there.

Top Fintech App Ideas Every Startup & SMB Should Build in 2026

If you are looking for innovative app ideas for fintech that can resolve customers’ pain points with simple yet effective solutions, here is a list of some reliable concepts that you must consider:

1. Mobile Banking Apps

These days, customers depend on digital banking to get fast and hassle-free access to banking services. High market demand has prepared the ground for the establishment of digital-only banks, like Ally Bank. Aside from that, customers’ will to get more convenience and leverage greater control and transparency has made neobanks quite popular around the world.

Traditional banks, like Bank of America, Huntington Bank, and Wells Fargo, have also built similar mobile banking apps to compete with neobanking apps developed by modern fintech startups. Generally, a fintech banking app gives users digital access to operations, such as:

- Opening accounts

- Closing accounts

- Making online transactions

- Processing deposits

- Applying for credit cards

Above all, banks created using innovative finance app ideas for startups also incorporate AI chatbots for providing quick consultation and financial advice.

2. Lending Apps

The old method of getting a short-term loan involves a huge amount of documentation and running from pillar to post. A lending application derived from profit-making fintech app ideas can come up as an alternative solution for all parties, as it connects potential lenders with borrowers on a single digital platform.

Lending apps, powered by AI and big data analytics, facilitate the loan assignment process by analyzing:

- Customer data

- Behavior patterns

- Shopping activity

- Credit history

Doing this helps them decide if a customer qualifies for a particular loan or not. The money borrowed through lending apps can be provided by banks or peer-to-peer lending processes (money borrowed from other people). MoneyLion is the best example of lending and saving apps, originated from fintech startup app ideas, that allows users to manage their personal finances efficiently.

3. Personal Finance Apps

For many people out there, managing personal finances is a tough nut to crack. Since we do not have financial literacy by birth, delivering financial advice to financially illiterate people is still one of the top fintech app ideas to take into consideration.

Today, robo-advisors offering online assistance on investment, retirement, and savings are slowly becoming the new normal.

So, if you are planning to develop a fintech app for personal finance management, exploring Honeydue for inspiration is a good idea. It is an application inspired by fintech business ideas that allows life partners to track shared household spending jointly.

It simplifies budget creation by integrating bank accounts, loans, cards, and investment accounts. Also, the couple can choose which financial account they want to share management responsibilities for, as per their preferences.

4. Mortgage Apps

Some time ago, the mortgage application process was a difficult task that required extensive paperwork. However, new advancements in technology have streamlined the assessment and funding workflows, allowing borrowers to avail contact-free financing securely with minimum hassle.

By automating previously manual processes using cutting-edge fintech solutions, lenders can now properly evaluate borrower qualifications and quickly deliver customized loans.

Better.com is one of the best mortgage apps, built on excellent fintech app ideas, and comes in handy for buying homes and recalculating existing mortgages. FairwayNow is another finance app in this field that is focused on getting home loans from the government.

5. Insurtech Apps

Building an application for potential customers in the insurance sector is one of the brilliant fintech app ideas to earn money from. Insurtech apps make use of state-of-the-art technologies, like AI and data science, to gather, process, and assess consumer data, identify risks involved in them, and simplify the insurance underwriting process.

By harnessing fintech app ideas 2026, insurance companies can speed up operations and enhance the quality of their customer service.

The apps in the insurtech sector target multiple insurance domains. For instance, myCigna is an app created by a global health insurance company named Cigna, which helps policyholders claim health insurance quickly and monitor their medical expenses.

On the other hand, Allstate Mobile is a car insurance app that enables users to swiftly submit insurance claims and enjoy loads of other helpful features for car owners.

6. Peer-to-Peer Payment Apps

Peer-to-Peer payment apps turn out to be useful for transferring money from one individual to another. The money sent from the customers’ account gets deposited directly into the electronic wallet of the recipient.

Modern peer-to-peer payment apps are connected with banks, digital wallet services, or individual payment service providers, like PayPal. So, if you are wondering how to create a fintech app for P2P payment, it is advisable to pay attention to top fintech app ideas, like Zelle and Venmo.

Zelle is a digital payment app headquartered in the US that lets users send money to their friends and families. It is backed by large financial institutions in the country because it ensures fast transactions without extra fees.

Similarly, Venmo is a US-based online payment service provider that enables users to distribute money to multiple people and divide expenses for entertainment, meals, housing, etc.

The best part of this app is that it allows account holders to transfer money to other users directly from their smartphones.

7. Crowdfunding Apps

Crowdfunding apps help new entrepreneurs raise a substantial amount of money for specific initiatives. They also demonstrate their proof-of-concept capabilities by posting their startup idea on a crowdfunding platform.

This helps them quickly see if any investors are interested in their project. Take, for instance, Kickstarter. It has a massive user base in this segment and can be considered an exceptional example of the best fintech app ideas in the crowdfunding ecosystem.

In addition to this, Patreon helps creative professionals crowdfund their content while Causes focuses on non-profit campaigns.

8. Trading & Investment Apps

Trading and investment apps are driven by the latest fintech app ideas and utilize a combination of multiple technologies, such as AI, ML, and Blockchain, to sharply improve trading results.

Algorithmic trading removes human error and emotional factors, makes data-driven decisions, and immediately responds to changing market conditions. Additionally, it allows traders to trade from various accounts at the same time.

AI and data analytics help users get rapid insights about possible investments and make well-informed decisions. Besides this, many trading and investment apps, including robo-advisors, are helping individuals learn trading and investing.

One of the best trading apps dominating the US market is Robinhood. The main fintech app ideas behind this application is to offer commission-free trading of stocks, ETFs (Exchange-Traded Funds), and cryptocurrencies through a mobile application.

9. Digital Payment Apps

The next fintech app ideas you can apply to build your project are digital payment apps. Yes, you heard that right! Although this segment appears to be a bit crowded, providing fast and risk-free money transfer services is still in high demand. Various financial services that fall into this category are:

- Electronic wallets

- Digital money

- Buyer-to-vendor money transferring app

- International money transfers

For example, Revolut is based on innovative app ideas for fintech that help users transfer money to many countries without fees and with the most affordable interbank exchange rates. This finance app provides a checking account, debit card, and commission-free stock trading, ensuring it can be used for both personal and commercial purposes.

10. Digital Wallet Apps

If you want to invest your hard-earned money in new fintech app ideas that will be at the fingertips of your clients, going with a digital wallet app makes sense.

People like to have the option that lets them keep all their plastic card data in one place and pay for the desired things instantly.

Building a digital wallet app can act as a replacement for both cash and physical credit cards while combining lucrative options of coupons and cashbacks.

Paypal is one of the most popular digital wallets based on modern fintech business ideas that allows people to make smooth transactions globally.

Millions of users trust and use PayPal because they are sure their data is completely protected, and they can make any payment with the touch of a few buttons.

BONUS:

11. Bill Reminder Apps

Last but not least, bill reminder apps are simple but successful fintech startup ideas that help users track their monthly bills. Although monthly bill tracking is usually a separate feature of a personal finance app, you can convert this functionality into a standalone app.

Such apps can help a multitude of people, especially those who are not able to pay heed to their regular payments, like rent, electricity, water, phone bills, etc. Therefore, developing a monthly bill tracker is an outstanding fintech startups concept that targets users with very busy schedules.

A case in point here is TimelyBills, which is a well-known bill reminder app. It doesn’t just let you analyze all your balances in one place, but also allows you to leverage all the benefits of bill tracking apps.

All you need to do is schedule all your bills, and the app will add them to your calendar and inform you about the next payment.

Must-Read Guide:

We hope you found this fintech app ideas blog useful and inspiring. To help you take the next step, we have also prepared a detailed Fintech App Development Guide that explains the complete roadmap and key factors involved in building a successful fintech application. This guide will give you a clear understanding of what it takes to turn your fintech idea into a fully functional product.

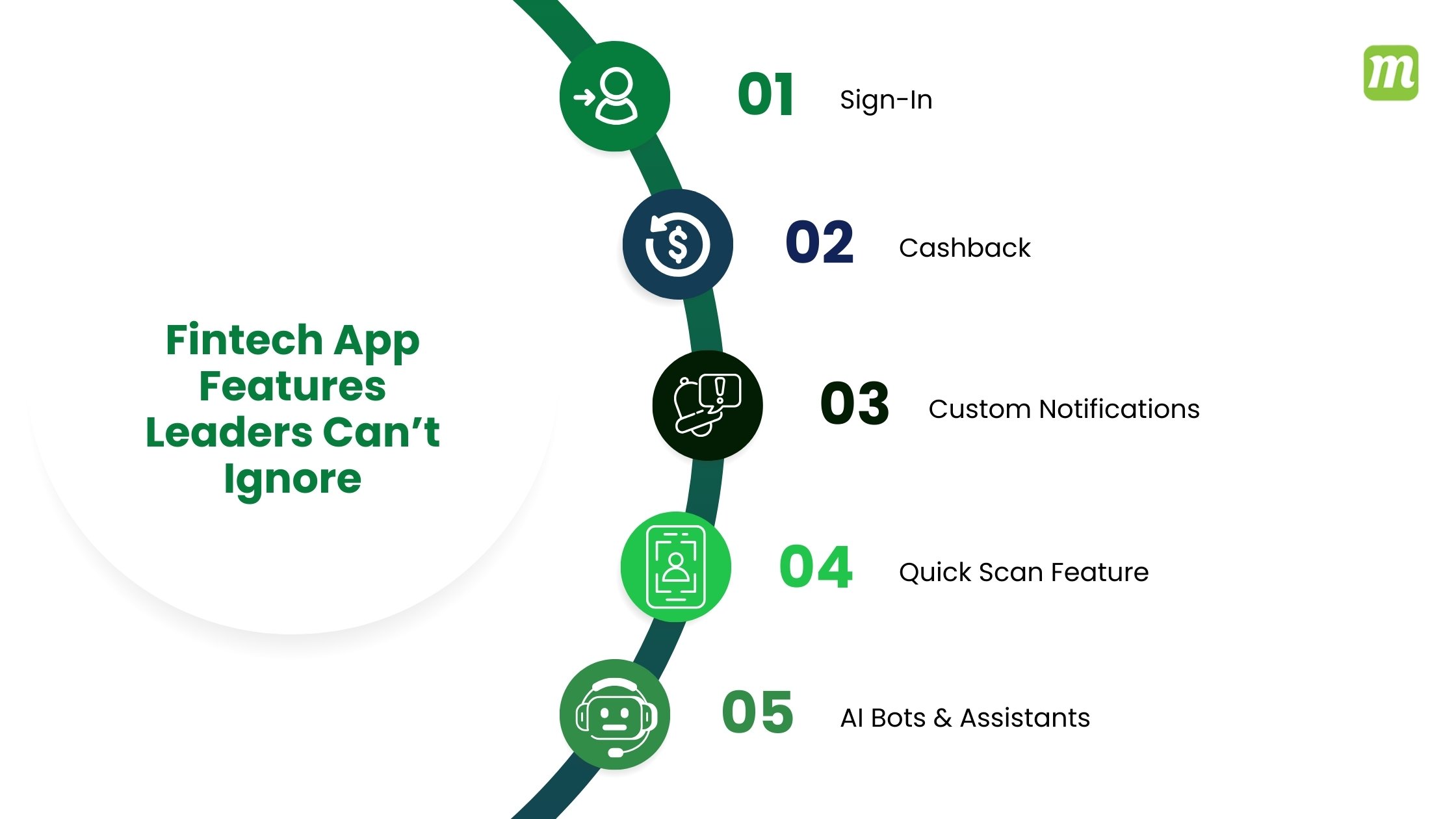

Fintech App Features Every Growth-Focused Leader Should Prioritize

Most fintech apps have almost the same sort of feature list. Therefore, your app need not be 100% unique. Sometimes, all it requires is a top-notch user experience and a few additional features to be able to compete with other fintech app ideas in the market.

1. Sign-In

Users should be able to log into your finance app smoothly and quickly. However, you need to ensure that it is equipped with all the necessary security measures, for instance, two-factor authentication.

And while you add this security functionality to your application, it is recommended to complement it with face and fingerprint identification. Be informed that using biometrics for the sign-in process will become a universal standard very soon.

2. Cashback

Cashback is a must-have feature for all the apps originated from fintech app ideas 2026. The more payments users process with your app, the more cashbacks will be credited to their account or wallet.

Integrating this feature into your fintech application will lead to higher customer retention rates and help in maintaining your overall revenue.

3. Custom Notifications

Custom notifications give users an improved level of personalization by allowing them to select which information they wish to receive. Giving them the freedom to unsubscribe from the alerts they do not like will definitely make your application more approachable and user-oriented.

4. Quick Scan Feature

One of the most annoying problems that a smartphone user faces while using an app, driven by top fintech app ideas, is having to enter data manually when they need to make a quick payment.

That’s when card number and QR code scanning features make a difference in creating a superb user experience.

5. AI Bots & Assistants

Developing and incorporating AI Bots into your fintech application is a smart idea, as they play a key role in providing instant customer support. In addition to that, your customer support team gets rid of excessive workloads, which is another reason having chatbots and robo-assistants integrated into your financial application is highly important.

Irrespective of which app you choose to create, it is suggested that you ensure that it contains basic features generally found in the fintech niche. This will allow you to minimize customer churn and their shift to other fintech service providers in the market.

The Road Ahead for the Fintech App Industry

Fintech is an ever-evolving industry with a myriad of opportunities to innovate and address major challenges in real customers’ lives. Whether you are keen to build lending apps, peer-to-peer payment apps, or digital wallet apps, there are endless possibilities out there.

The top 10+ fintech app ideas discussed above offer a starting point to enter the financial ecosystem, and once you have entered this field, the future of fintech is bright.

So, if you have a clear vision to make financial services more accessible for unbanked and underbanked populations, InnovationM is the right partner to turn your concept into a successful financial application.

Frequently Asked Questions About Fintech App Ideas

1. How to start a Fintech startup?

To start a fintech startup, all you need to have is clear fintech startup ideas, compliance readiness, and the right tech stack at your disposal. Below is a step-by-step process to guide you how to start your journey:

Step 1: Find Your Niche – Select a niche depending on a specific pain point in the fintech industry, such as payments, lending, or insurtech. Picking a fintech business opportunity earlier helps in positioning your audience and determining product preferences.

Step 2: Decide Your Value Propositions – Research your potential competitors and build a different solution. Your fintech startup app ideas must improve efficiency, increase trust, and enhance user experience to a great extent.

Step 3: Build a Scalable Model – Create a stable revenue system, for example, subscription fees, and ensure that your system can scale seamlessly as and when demand increases.

Step 4: Prioritize Compliance and Security – Every business associated with the fintech app industry must comply with strict financial and data regulations. Also, make sure to integrate security and reporting capabilities in your product from the start to establish user confidence.

Step 5: Develop & Test an MVP – Build a minimum viable product to test your latest fintech app ideas, receive feedback, and optimize it before launch.

Step 6: Launch & Grow – Launch your newly developed fintech application and keep adding useful features to grow in the long run.

2. How do Fintech apps make money?

Some tried and tested methods to make money through fintech apps are in-app advertising and referrals, business partnerships, subscriptions, and treating the API as a product.

3. How to secure a fintech app?

Securing a fintech app requires implementing powerful strategies, such as:

A. Using data encryption, access policies, DLP (Data Loss Prevention) features, and backup systems to restrict data leakage.

B. Leveraging AI, ML, and DPI (Deep Packet Inspection) firewalls to identify and stop malware attacks.

C. Utilizing biometrics and two-factor authentication, trustworthy password policies, and credit and identity monitoring to avert identity theft.

D. Preventing misuse of APIs by taking advantage of API access authentication and other relevant measures.

E. Relying on only trusted cloud service providers and adopting robust cloud security policies.

4. What are the best programming languages to build a Fintech app?

Once you have decided the best fintech app ideas for your project, you must use Java, Python, C#, C++, and Ruby to craft your financial app. Apart from that, if you want to scale your fintech application further for high performance, you can use technologies like React, Flutter, and Node.js.

Also, if you want to make your application more secure, automated, and transparent, leveraging GCP, AWS, and Azure for cloud computing, TensorFlow for AI/ML systems, and Ethereum and Hyperledger for blockchain applications makes sense.

5. What are some successful examples of financial apps?

Two successful examples of real-world financial applications are:

- Mint: Mint is one of the famous budgeting apps that allows users to manage all their financial transactions in one place. Due to its notable features, such as bill alerts, investment tracking, and custom budgets, Mint was listed on Forbes Advisors’ Best Budgeting Apps in 2023.

- Robinhood: Robinhood is a commission-free stock trading app that lets users buy and sell stocks, ETFs (Exchange Traded Funds), and cryptocurrencies, helping them shape their financial future for better outcomes. What else? This app makes investing accessible for a large number of users by offering a user-friendly interface.

End to End Technology Solutions

End to End Technology Solutions